Online Reverse Gst Calculator

To work out the price without GST you have to divide the amount by 11 11011100. To calculate Indian GST at 18 rate is very easy.

Online Gst Calculator Easiest Way To Calculate Gst Amount

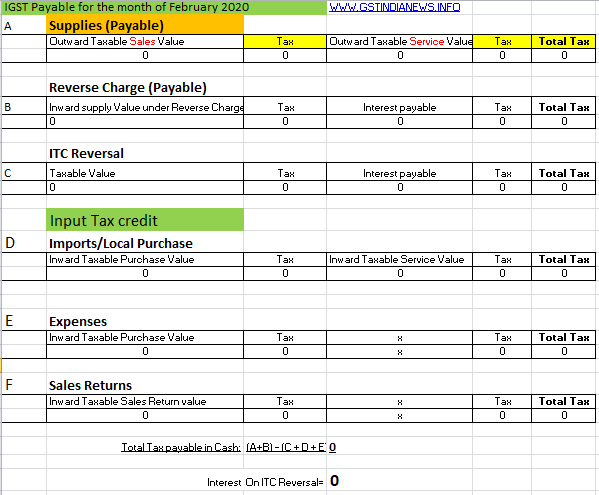

So you have to pay a GST on reverse charge of Rs.

Online reverse gst calculator. 900 5000 x 18. The resulting amount includes GST and QST. Find your GSTHST rebate for a new home.

Just multiple your GST exclusive amount by 007. Reverse charge will be applicable in the situation when a vendor who has not applied for GST supplies goods to the one who is registered under GST in this case GST reverse charge will be appliedHere the receiver will pay the fees directly to the government instead of the supplier who is not registered under GSTThe dealer who is registered under GST and have to pay. For the reverse calculation GST and QST you must take the amount with taxes and divided by the combined rate of 114975 to obtain the original amount without the two taxes.

To figure out how much GST was included in the price you have to divide the price by 11 1101110. Using your email address. This video is for calculating before gst amount and also the gst rate from mrp which included gst.

A free online Indian GST calculator to calculate how much your product or service would cost after the application of GST. Amount Before Taxes 4425. Rate of GST.

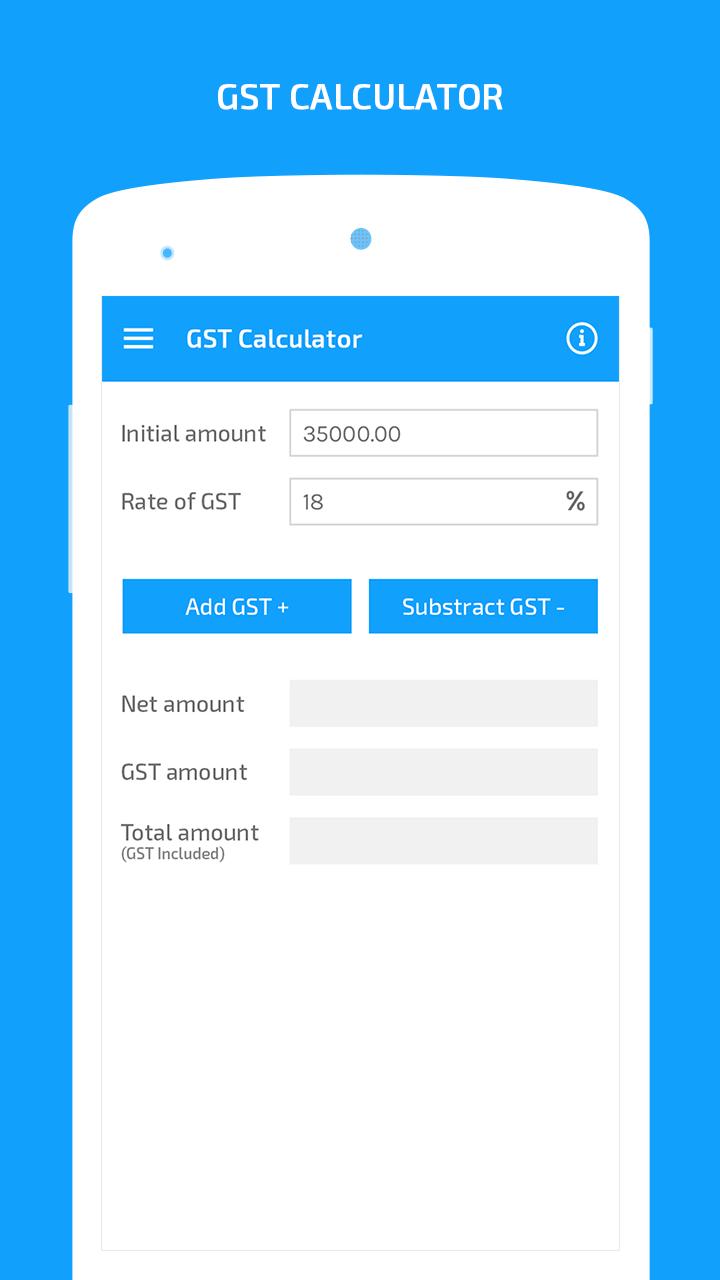

Enter GST inclusive price and calculate reverse GST value and GST exclusive price. GSTHST Calculator Reverse GSTHST Calculator. In the case of reverse charge also the calculation will be same.

10 is GST exclusive value 10 018 18 GST amount To get GST inclusive amount multiply GST exclusive value by 118. 300 is GST exclusive value 300 007 21 GST amount To get GST inclusive amount multiply GST exclusive value by 107. Check home page if you need sales tax calculator for other province or select one listed on the right sidebar.

When you enter your email or sign in through social networks you agree to that your email address will be added to the subscription list for sending target news and special offers. How to make calculation of GST in case of reverse charge. Add GST Subtract GST.

Goods and services tax GST calculator online. How to calculate GST backwards. To figure out how much GST was included in the price you have to divide the price by 11 2201120.

Province Provincial Tax Federal Tax. Sales Tax Rates for All Provinces in Canada. 5000 from a person and you are required to pay GST on reverse charge at the rate of 18.

PST 8 354 GST 5 221 HST 13 575. Its simple just apply this formula. To work out the price without.

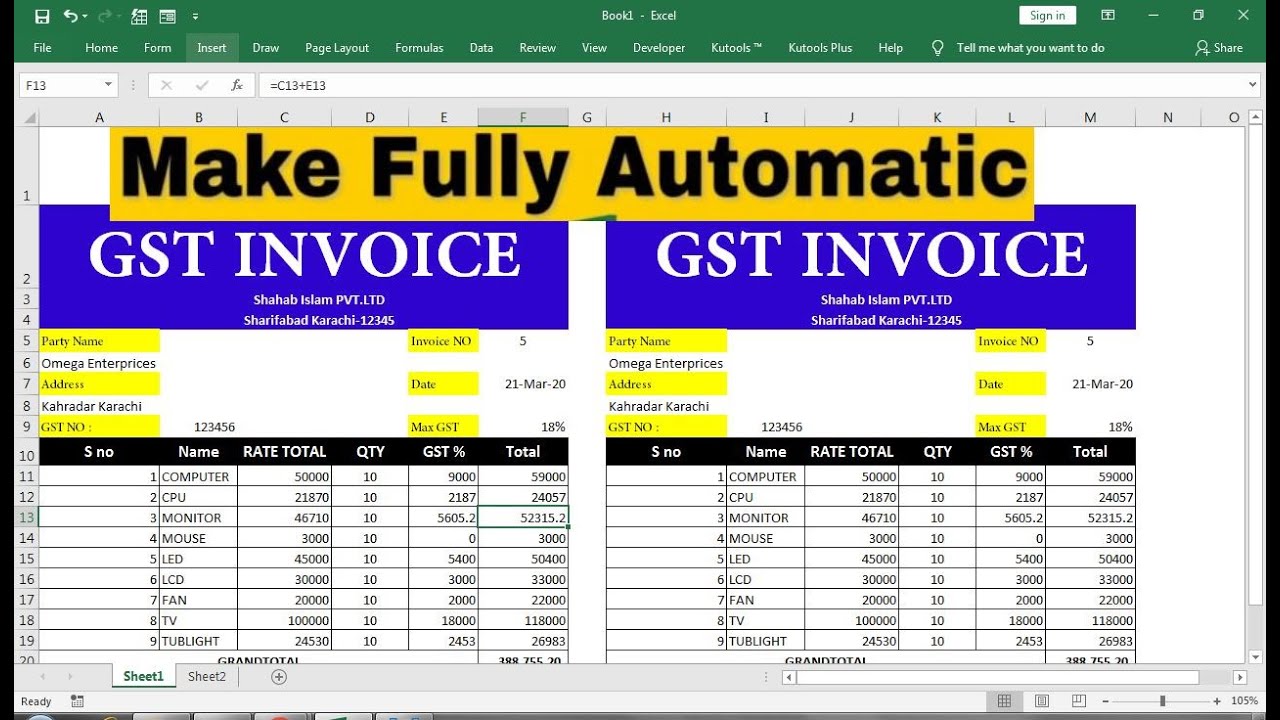

1000 and the GST rate applicable is 18 then the net price calculated will be 1000 1000X 18100 1000180 Rs. Current 2021 GST rate in Canada is 5. For example you have purchased goods worth Rs.

The calculation of the GST and QST can also be done in one step you must use the rate of 14975 to calculate both taxes. Write how to improve this page. The GST Goods and Services Tax is a common comprehensive nation wide tax based on the VAT Value Added Tax principle which replaces several taxes levied by the Central and State governments upon the products and services.

To get GST Amount GST Amount GST Inclusive Total Amount x GST Rate 100 GST Rate. When adding 10 to the price is relatively easy just multiply the amount by 11 reverse GST calculations are quite tricky. Compound interest calculator.

14 Zeilen Harmonized reverse sales tax calculator GST PST and HST 2021. If a goods or services is sold at Rs. Adding 10 to the price is relatively easy just multiply the amount by 11 reverse GST calculations are quite tricky.

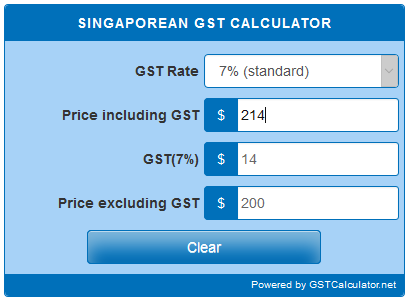

Given price is GST inclusive and reverse GST calculation must be performed. GST calculation can be explained by simple illustration. To calculate Singaporean GST at 7 rate is very easy.

One of the major steps to curb falsefraudulent claims of the input tax credit was initiated under Goods and Services Tax regime by introducing a procedure to reverse the amount of input tax credit availed within 180 days in case no or part payment is made to the supplier of. Just multiple your GST exclusive amount by 018. GST tax calculation.

If CGST SGST is to be levied then CGST SGST of Rs. GST allows setting off of tax paid on inward supplies purchases against the liability of outward supplies sales. Final_priceis GST inclusive price Calculation of GST part in this case is more complicated gst final_price 5 105 final_price 21 base_amount final_price 105.

Gst Calculator For Android Apk Download

How To Calculate Australia Gst In 2021 Australia Goods And Services Goods And Service Tax

Gst Calculator Calculate Your Gst Amount Online Under Different Tax Slabs

Automatic Gst Calculation In Excel Excel Party Names Automatic

Indian Gst Calculator Gstcalculator Net

How To Correctly Calculate Gst Figures Kiwitax

Gst Calculator In India Online Formula With Example Excel Sheet

Emi Calculator And Gst Calculator Android App Codelib App In 2021 Mobile App Templates App App Template

Gst Calculator In India Online Formula With Example Excel Sheet

First Goods And Service Tax Calculator By Casio In India

Casio Mj 12gst Desktop Calculator Buy Mj 12gst Online At Best Price Casioindiashop Com

Reverse Gst Calculator How To Calculate Reverse Gst Legaldocs

Singaporean Gst Calculator Gstcalculator Net

Casio Gst Calculator For Manual Gst Invoicing Youtube

Make Gst Invoice Using Casio Gst Calculator Mj 120gst Youtube

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

Post a Comment for "Online Reverse Gst Calculator"